According to the German Federal Ministry of Finance, the coalition committee agreed on 3 June 2020 on key points of an economic stimulus package to address the economic consequences of the corona pandemic. Among other things, the value added tax in Germany will be reduced for a limited period from July 1st 2020 till December 31st 2020. The regular tax rate will be reduced from 19% to 16%, the reduced tax rate from 7% to 5%.

This information is applicable for you if you vend your products or services inside Germany or from another EU country to Germany (over a specific level of turnover).

How to change VAT in OXID eShop

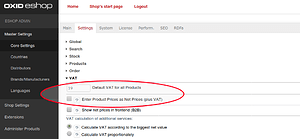

Actually this change is easily done in OXID eShop: go to Admin → Master Settings → Core Settings → Settings → VAT and change the option Default VAT for all Products from 19 to 16.

The reduced tax rate can be adjusted in each single product from 7% to 5%.

When do you have to switch the VAT rate?

This tax reduction is valid from exactly July 1st 2020, 0:00 AM until December 31st 12:00 PM. That means that every order in this time frame shall have a VAT rate of 16% (resp. 5% for reduced tax rate).

Automating stuff

Thanks to the Daniel at D³ Data Development, it is possible to automate this change so you don’t have to spend your next New Year’s Eve on the keyboard. They thankfully wrote the module “TaxRatesAdjustment” that batch changes the VAT rates, the regular one as well as the reduced rate. This module is set under open source license GPLv3 and can be used by everyone. If you fix a bug in it or make other adaptions, please think of sending a pull request back to the original: d3/taxratesadjustment - Packagist

Challenges

However, as usual there are some potential pitfalls:

- If you activated the option Enter Product Prices as Net Prices (plus VAT), the prices in front end will be shown either as net prices (if option Show net prices in frontend [B2B] is chosen) or the new tax value will be added. For example: net price = 100 €, old gross price = 119 €, new gross price = 116 €. In this manner, it would be a price reduction within the scope of the coalition committee.

- If you didn’t activate the above named option, the new VAT of 16% will be subtracted from the the old gross price – finally your B2C-Client would have to pay the same value as before and it would equal an increase in price. For example: old and new gross price = 119 €, old net price = 100 €, new net price = 102,59 €.

- Please note that in case of changes to existing orders, always the current VAT rate will be applied.

If you want to change your prices globally in your OXID eShop instance, please feel free to visit our forums for assistance.

And of course, there will be other interesting challenges in we cannot answer, thinking of vouchers that haven’t been redeemed yet, recurring payments, installments etc. These are clearly topics for your tax advisor, and of course you can also discuss it in the forums.